AARP would like you to reconsider your attitudes toward fraud victims. It notes that the language we use when referring to victims of frauds or scams often stigmatizes the victim. Phrases like: "I would not fall for that!" "How could you fall for this?"

According to a study conducted by AARP, the FINRA (Financial Industry Regulatory Authority) Investor Education Foundation, and Heart+Mind Strategies 32% of Americans agree with this statement- “Honestly if you fall victim...a lot of that is on you.”

Also, according to the study, 83% of Americans say that a scam can happen to anyone. Yet, 53% say the victim is to blame for "falling for fraud.”

Much of this attitude is not anyone’s fault. In America we have an attitude of the independence of the individual and for personal accountability.

This attitude may also be a result of some misunderstanding about fraud and fraud victims. Some people mistake fraud with consent. Fraud is defined as “…an intentionally deceptive action designed to provide the perpetrator with an unlawful gain or to deny a right to a victim.”

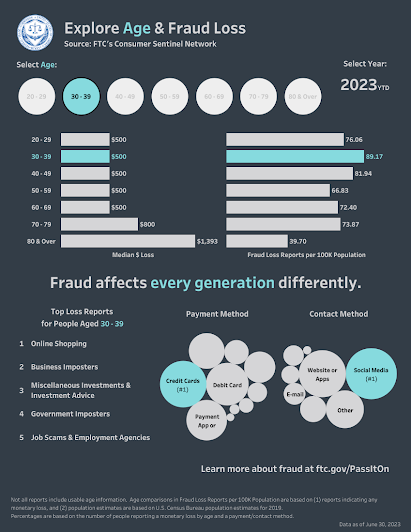

Also, we often think of fraud victims as the elderly with diminished cognitive abilities. But recent statistics show that younger people report losing money to fraud more often than older people. For example, 43% of 20–29-year-olds reported losing money to fraud versus 23% of 70–79-year-olds. The graphic below, from the Federal Trade Commission (FTC), shows that more younger people report losing money to fraud than older people and that when they do lose money, younger people lose less than older people. For example, for 30-39-year-olds 89 per 100k of population report losing an average of $500 to fraud. While for 80–89-year-olds 39 per 100k of population report losing an average of $1,393 to fraud.

Being victimized by fraud, like other crimes, brings a feeling of loss, violation, and victimization. The Identity Theft Resource Center (ITRC) points out that it has detected an increase in thoughts of suicide by fraud victims who have contacted it. ITRC provides a toll-free phone number (888-400-5530) for fraud victims to call for help and advice. It also conducts an annual survey that measures the effects of identity theft. As the CEO, Eva Velasquez, points out in its latest Consumer Impact Report, ITRC has noted that 2-4% of its survey respondents identity theft victims have considered suicide for almost two decades. In 2020, during the pandemic, that figure jumped up to 8%. In 2021 it grew to 10%. In 2022, the number of people who said that they considered suicide rose to 16%.

The ITRC attributes this increase to the rise of sophisticated social engineering scams, an increase in very large dollar losses, including an increase in six-figure losses, and a dismissive or judgmental discussion around fraud, even though everyone is vulnerable to it.

AARP urges everyone to treat fraud victims with kindness and empathy. If a relative or friend has been victimized by fraud, show empathy to them. Focus the attention on the fact that the criminal stole from them. Use the terms “criminal” and “crime” instead of “duped” or “fell for.” Three things you can do to help a fraud victim include,

·

Skip the blame and shame.

·

Listen with compassion.

·

Help out with fraud reporting, be it to a local

police, bank, FTC, or FBI

Like victims of other crimes such as assault, domestic

violence, or theft, fraud victims deserve our empathy and support.

AARP:

https://www.aarp.org/money/scams-fraud/info-2022/victim-blaming.html

https://www.aarp.org/podcasts/the-perfect-scam/info-2023/victim-blaming.html

Identity Theft Resource Center:

https://www.idtheftcenter.org/

https://www.idtheftcenter.org/publication/2023-consumer-impact-report/

Federal Trade Commission:

https://www.ftc.gov/news-events/data-visualizations/explore-data

No comments:

Post a Comment